Investing Money - How to Invest

4nvesting money can be daunting for beginners. This article explores how to invest your money, from basic concepts to professional, expert tips on investing.

Who should read this article?

This article will be useful if you are interested in investing money, but do not know where to start. We focus on the most important principles you should follow when you invest your money, starting from the basics through to the professional approaches we take as investment advisers. Please bear in mind that this content is designed for information only, as investing can be more complex in practice. If you need further guidance, we recommend that you seek professional assistance. You may have read similar warnings in the past, but investments can fall in value as well as rise, so approach this topic with sensible caution!

Key topics covered in this article

A beginner’s guide to investing money

Start here if you are new to investing money. We explain some of the key concepts around investing money, and what you need to know when thinking about how to invest.

What are investments?

Investments are any assets you buy where you attempt to get a profit in return for your money. The general idea of investments is for your initial capital to grow over time. Many investments also generate an income, which you can receive or use to enhance your capital. Most investments are long-term in nature.

Types of investments

Investing money can take many forms, but here are the main types of investments you might come across:

- Shares (equities)

Shares entitle you to a share of a company, usually accessed via a recognised stock market (such as the London stock exchange in the UK). The shares will grow in value over time if the company performs well. You will also receive a share of the company’s profits via dividends. The value of shares fluctuates daily, so this can be a volatile investment type; - Cash

Cash investments are typically bank savings accounts, which do not grow the original capital, but pay a low level of income as interest. Cash investments are not volatile, but tend to grow very slowly, and usually behind inflation; - Property

Property investments usually involve buying a physical residential or commercial building, land, or other agricultural assets. You can also buy shares of property investments via collective investments. You might expect a property to grow the capital value over time, and also to pay you an income as rent; - Fixed interest (bonds, or gilts)

You can lend money to a company or government, which pays the initial capital back after a fixed period. The bond issuer will pay you a fixed income while you hold the investment; - Foreign currency

You can buy foreign currency with the hope of generating a capital growth if the value of that currency rises compared to your own. This tends to be a volatile investment as values change by the minute; - Art, antiques and other collectables

Investors buy assets like art, antiques, or any other collectable items (cars, wine etc.), with the hope that these assets will increase their capital value; - Commodities

You can buy traded commodities that are required for industry to function. Commodities include: precious metals, raw materials, and agricultural produce. Investors hope that the capital value of these assets rise when demand outstrips supply; - Loans

You can lend money to individuals or companies directly, generating a profit on the interest rate charged to the borrower. - Specialist

You can invest in particular specialist areas, which often come with significant risks ad the aims of large returns. This might include investing in start-up companies.

Investment returns

Investment returns tend to come from a variety of sources.

- Capital growth

Capital growth comes when the sale price of your asset is greater than the purchase price. This can be delivered by demand for the asset, depending on a variety of factors. Effectively, if someone is willing to pay a greater price for your investment, then it will generate capital growth. Of course, capital values can fall as well as rise; - Dividends

Shares pay a dividend, which is a share of the profits of the company after tax. Dividends may rise or fall depending on the success of the company, and the plans for the expansion of the company. Dividends are never guaranteed when investing money, so you cannot always rely on them; - Interest

If you have savings in a bank, or fixed interest assets, these pay an income as interest. The interest may be variable, fixed for a period, or for the lifetime of the asset; - Rent

Property pays an income in the form of rent for the use of that property. Rental income will change according to demand for that property. Of course, not every tenant will pay their rent on time!

Investment costs

Inevitably, there are costs associated with investing money. We consider investment costs in greater detail below. Investment costs are incurred for a variety of reasons, such as:

- Administration

- Expertise

- Transactions

- Advice

- Tax

Investment risks

All investments carry some level of risk. There is no such thing as a risk-free investment, so you are gambling your capital to some degree. Much of this guide is aimed at managing investment risk, and we consider this area in more detail below. The risk you take when investing money varies from very low through to very high, depending on the assets you buy, and the way you hold your investments. Key investment risks include:

- Capital risk – you might get back less than you put in;

- Inflation risk – the cost of living might grow faster than your investment returns.

In general:

- Low risk investments tend to make small gains, but have little prospect of a capital loss. Your main risk is long-term inflation.

- High risk investments tend to be provide more volatile returns, but expect to return a higher level of capital growth over time to compensate for this extra risk. Your main risk is short-term volatility.

Investment term

Your investment term will affect how to invest your money. Some investments are intended to be short-term, while other investments can be long-term in nature. These will have very different characteristics, and expectations. In general:

- Short-term investments are simpler in nature, have easier access, and lower growth prospects

- Long-term investments might be more complex in nature, could have less flexibility, but higher growth prospects

For most people investing money is not the same as portrayed in the media. Most investors do not sit by banks of data screens shouting ‘buy’ and ‘sell’ orders down the line. Most investments are bought and held for a long period, aiming to generate a return over that time. Time in the markets is an important concept when investing money.

How to buy investments

There are a wide range of ways to invest money. This depends on your need for convenience, how much you want to pay, and your experience. We explore investment tax wrappers below, as well as the tax consequences of investments.

Common investments

The most common investments held tend to be:

- Cash

We all hold at least one bank account, which allows us to receive income and pay our bills. You can extend this to holding savings accounts, which might pay a higher interest return, possibly with lower access to your cash; - Property

Many people take their first long-term investment by a property, often to live in. This can be developed buy buying residential or commercial property to rent (buy-to-let); - Shares

Most people invest money in the stock market to buy shares. this might be directly held, or via some sort of investment product such as a pension plan or shares ISA. A stock market is simply a way for you to buy commonly-held, larger companies. The stock markets exist to bring together buyers and sellers. Essentially, a company share will rise in value due to a variety of factors such as the financial performance of the company, the health of the overall economy, and simple demand for that investment.

Direct investment

Usually, the cheapest way to invest money is to buy directly from a recognised exchange, or on the open market. However, you need to be a bit more experienced and knowledgeable to buy directly, as this can be complex.

In the UK, the London stock exchange offers direct purchase of shares in over 3,000 publicly traded companies. You can also invest in less-established companies via the Alternative Investment Market (AIM). You can purchase shares in privately-held companies directly with the owners, but these shares are less accessible given that they do not operate on a recognised exchange.

You can buy cash investment directly from a bank.

You can buy property using an estate agent.

Collective investments

You can also buy collective investments, which pool your money with other investors, typically in similar assets (shares, bonds, cash, or property).

This has the advantage that an expert might make investment decisions on your behalf. Pooled investments tend to be more expensive than directly-held investments, but offer diversifying benefits as you can spread your money around a variety of assets within the fund.

There are a wide variety of different collective investment types, and each can be held within different investment tax wrappers.

You can use pooled investments to buy pretty-much any type of investment imaginable: shares, cash, property, fixed interest, and even more specialist investments.

Types of collective investments

There are many types of pooled investments. These can be active or passive in style.

- Open-ended funds

Examples of open-ended funds are unit trusts or OEICs. Your fund manager will take in money from investors and use this to buy assets in the fund. The investment is open-ended as the fund manager can issue more units if the fund has more investors.You buy a share in this collective investment in the form of units in the fund. If those units perform well, the unit price will increase and your asset value will grow. Open-ended funds allow you to access your money at any stage, based on the underlying asset values of the fund. - Closed-ended funds

Examples of closed-ended funds are investment trusts. An investment trust is a type of company that raises money in tranches from investors that are used to buy assets in the fund. This means that the investment is closed-ended as the number of shares is limited. You buy a share in the collective investment in the form of a share in the fund. If the share’s assets perform well, your assets will grow in value. Closed-ended funds are different to open-ended funds as they allow the investment manager to borrow against the assets in the fund. This increases the risks of the investment, as it can boost returns in rising markets, and also worsen losses in a falling market (known as gearing). With investment trusts you can only sell your investment if you can find a buyer for the shares. - Index funds

Some collective investments are specifically designed to track an index, for low-cost investing. Examples include Exchange Traded funds (ETFs). ETFs are traded on stock exchanges like shares. They have become a very popular way of low-cost investing. When you invest into an ETF the fund manager will simply buy more of the same index that is tracked by the fund, keeping costs relatively low. - With-profits funds

With-profits funds allow you to pay into an investment with other people. The funds add bonuses each year according to the performance of the underlying investments. With-profits funds allow you to smooth the returns of your investments, so that growth is more stable and less volatile than in other investments. The general principle is that these bonuses cannot be taken away once added, so you should only ever see your investment value rising. You can also get a final bonus when you sell out of the fund, provided investments have performed well. However, with-profits funds can also levy a ‘market value reduction’ if you sell from the fund at a time when holdings have fallen in value. This means that in practice investments can fall in value, and it can be difficult to see the underlying value of your holdings.

Investment tax wrappers

You usually buy your investments within a regulated tax wrapper. Here are some of the main investment tax wrappers, although we consider this area in more depth below.

- Direct

This might be a simple account like a bank account, or direct holdings such as shares; - General investment account

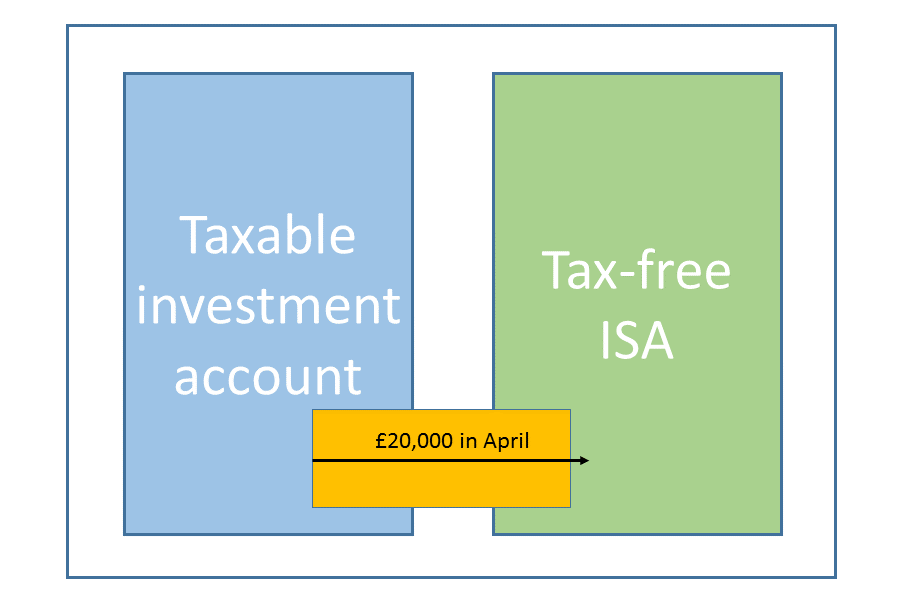

This is a taxable investment account that allows you to hold a variety of directly held investments such as shares, or pooled investments like funds. - Individual Savings Account (ISA)

An ISA is a tax-free tax wrapper around another account. The most common ISAs are cash ISAs, which make a bank account tax-free; the alternative is an investment ISA, which makes a general investment account tax-free. Growth, income, and withdrawals from ISAs are tax-free. - Pension plan

A pension plan is a long-term retirement savings plan, that gives you initial tax relief on your savings. Growth in pension plans is tax-free. You can take out 25% of your fund within limits once you reach age 55, and other withdrawals are subject to income tax.

Who offers investment advice?

You can get investment advice from a variety of sources. Just be careful to understand what advice you are getting, and where this advice applies (or stops).

- Personal contacts

You may get investment advice from a trusted friend or family member. Just remember that this advice does not come with any guarantees or regulation to back it up. You are on your own if something goes wrong. - Financial institutions

Many banks and financial institutions offer investment advice. Most only offer advice on the company’s own products, or sometimes a limited panel of providers. This advice may be appropriate, but it can mean that the advice given might not be as appropriate than if the adviser had considered other alternatives. - Stock broker

Stock brokers are investment professionals who exist to execute trades on behalf of clients. You might use a stock broker for expertise and convenience. However, a stock broker will not make specific personal recommendations based on your personal circumstances or tax position. - Financial adviser

A financial adviser who specialises in investments is likely to make a specific, personal recommendation based on your individual needs, and wide circumstances such as tax. Most financial advisers are independent of product providers, and so can advise on the whole investment market. Some financial advisers are restricted to a small panel of products or investments. This can mean their advice is limited to these investments, which could mean that their recommendations are not as wide as independent advisers. If you choose this option, your investment adviser will make a recommendation based on your personal circumstances, but they will not execute this recommendation without your permission. This gives you more control over investment decisions. - Discretionary management

If you choose this option you outsource all investment decisions to a professional adviser, who will manage the running of your investments without asking your permission once you have agreed the outline parameters. Discretionary management is convenient, but offers you less control over decisions, and you can get unexpected tax consequences as your investment manager will not consider your individual tax circumstances. Discretionary investment management is usually the most expensive investment option.

All investment professional advisers are authorised and regulated by the Financial Conduct Authority in the UK. This means that they should appear on the Financial Services Register, which lists their permissions to give advice, as well as their status as an adviser. Financial regulation is extensive in the UK, so all investment professionals who offer advice should come with a variety of additional safeguards:

- Professional qualifications

- Ongoing professional development

- Oversight from a regulator

- Membership of a professional body, such as the CISI (our professional body)

- Appropriate ethics

- Investment research tools

- Insurance and capital

- Access to the Financial Services Compensation Scheme

- Access to the Financial Ombudsman Service

Of course, if you take investment advice from a regulated professional adviser you will have to pay initial and ongoing fees for advice and service.

General principles for investing money

There are a number of general principles to follow when investing money. This section explores some of the fundamental principles of how to invest.

Plan before you invest

Of course, it makes sense to have a plan when investing money. Really, you should start with the end in mind. Consider what are your investment goals, such as:

- What is the purpose of the investments?

- What is your investment term – how long are you investing for?

- Will you need access to the money?

- Are you investing for growth or income (or both)?

Ultimately, you should aim to adapt your investments to your practical needs, rather than just the need to grow your assets. Once you know the goals of your investments, you can start to plan how to invest.

Discipline with investments

One of the most important factors with successful investors is their ability to be disciplined over time. Investing money should be successful for you if you keep your behaviour under control, and avoid the obvious pitfalls in this guide.

Sticking to your investment plan

Once you have invested your money, it is important to stick to the investment plan. You should set the investment direction, and only correct your course when something needs your attention. Too much tinkering can lead to under-performance for a variety of reasons.

Evidence-based investing

We only use tried-and-tested, evidence-based investment ideas, and learn from the mistakes of others. We are not interested in the latest investment trends. Most investment success comes from temperament rather than insider knowledge

Monitoring investments

You should regularly monitor your investments, but not too often! Try to avoid the stress of daily updates on the performance of your investment holdings. Too much investment monitoring can lead to stress when you see the investments rise and fall. The general trend should be upwards over time, and the investment volatility seems less when you examine your investments over a longer period. Of course, you should monitor your investments, so you cannot just set up your plans and then hope for the best. We tend to schedule an annual review of the investments, but monitor progress every 3 months. Of course, if something important changes in your portfolio you may need to monitor the position at other periods. See below for more about investment research.

Understanding your investments

You should only invest in an investment product if you understand it, and the reasons for holding it. We believe that we should keep things as simple as possible. It is unlikely you need complex, over-engineered investment solutions. We want to educate you in the investment process. Investing is mostly about building a plan, sticking to it, and monitoring it while avoiding temptation to try to beat the markets.

Investment process

Investing should be straightforward, and repeatable – more science than art. Without a considered and repeatable investment process you will not be able to get the best out of your investments. Many investors fail because they do not apply a consistent approach to their investing. You can avoid costly errors by removing emotion from your investment decisions. If you manage your own behaviour you will see results

Regular investment reviews

Most amateur investors do not review their investments. We recommend that you schedule regular valuation updates, and annual reviews to ensure that gradual adjustments are made to keep you on track.

Investment term

Your investment term is the length of time over which you plan to invest.

When investing money, this is generally a period greater than 5 years, simply because this is a reasonable period for you to generally expect to overcome investment charges. A 5-year investment term will reduce the chance that your investments lose value, although of course this cannot be guaranteed.

Investment term and risk

Think about when you will need access to your investments. Broadly, the longer until you need access to your funds, the greater the risks you can afford to take. This is because you can afford to ride out inevitable, short-term, temporary falls in the value of your investments, provided you have enough time ahead of you. A longer investment term should lead to greater capital growth. Read more about investment risk below.

Key dates

Many investments are built around important dates, such as retirement, paying off a mortgage, or a child’s education. Again, the general principle applies when investing money that the longer the time between now and the important date, then the greater risk you can probably afford to take.

Switching from growth to income

It may be a mistake to reduce the level of risk as you get closer to the date you plan to access your investments, unless you plan to liquidate the holding entirely to spend all the capital at that date.

If you plan to take a gradual income, this will inevitably extend the term of your investments. Imagine accessing your retirement funds at age 60, but living for another 25 years. In this situation, continuing to take investment risks should help your investments to grow more over time, extending the income potential of your holdings for a longer period.

Life expectancy or longevity

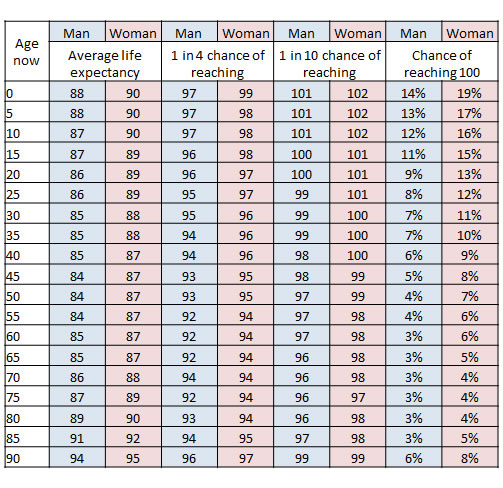

You may live a lot longer than you imagine. Take a look at this life expectancy data from the Office for National Statistics in 2019.  This should affect your thinking on how to invest for 3 reasons:

This should affect your thinking on how to invest for 3 reasons:

Greater risks

Longer life expectancy means that you can afford to take greater risks, since you have more time to make up temporary downturns.

For example, if you are investing money for the rest of your life, your investment term is likely to be to the date you die. This is probably a very long period. Say you are aged 60 now, and the average life expectancy is to age 85. That makes your investment term 25 years, and possibly longer.

Income for longer

If you are likely to live longer, you will need to extend your income for a greater period.

This makes it important to set up the risks you take with your investments correctly.

Inflation

The longer you live, the greater the impact of inflation on your investments and income. Generally, we want an increasing income from our investments, so you also need the underlying capital to grow too.

Investment risk

Investing money is all about managing risk.

All investments involve some sort of risk, from almost no risk, to a high level of risk. To learn how to invest money, you need to understand the fundamental principle that the greater the risk you take the greater returns you should generate, on average over time; the reverse is also true.

Therefore, over time, you should expect low risk and low returns on assets such as cash or bank accounts (perhaps below inflation), with greater risk and greater returns on riskier assets such as shares.

Different assets are exposed to alternative forms of risk (such as volatility in shares, or inflation in bank accounts). Do not be lured into believing that you can take risk off the table by being cautious. As the section below on cash and inflation shows, all you would do is to swap volatility risk for inflation risk. If you are too cautious for your goals then you risk running out of money, or poverty.

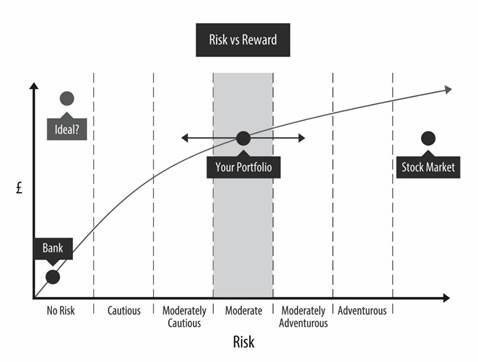

Risk vs reward when investing money

This chart shows the relationship between risks and returns.

This chart shows the relationship between risks and returns.

The curved line represents the theoretical ideal trade-off between risk taken, and the returns on your money. Typically, over time, if you take greater risks with your capital, you should expect additional returns, although your investments may fluctuate more.

Based on past returns, you can estimate the possible growth and income. Of course, none of this can be guaranteed. If you take lower risks with your capital, you should expect lower returns over time, and you risk inflation eating into your returns.

When investing money you should aim to match the investments to your chosen risk style. Your goal will then to stay within your chosen risk band, as shown in the chart, and as close as possible to the ideal balance between risk and return.

You can amend this as your goals or circumstances change over time. A professional investment management service like we offer aims to oversee your investments and make small changes to keep you on track within the risk parameters you set. When investing money in this way, you can also use past returns to guide your assumptions (with careful consideration) to estimate how your decisions now might impact on your future goals.

How much risk are you prepared to take?

If you work with a financial adviser, they should help you to establish the maximum level of risk you can take before you start to worry about the performance of your investments. Most do this with the help of some sort of investment questionnaire. This asks a variety of questions designed to understand how you react to certain situations that could happen with investing money. These questionnaires are open to some criticism, since everyone has a different approach to risk, and will put their own subjective bias into their answers. This is only the start of the process, as you should use these results to explore the meaning of your approach to risk. When investing money, your risk appetite is probably shaped by a number of factors:

- Your investment experience and expertise

- Your investment goals and term

- What would happen to your lifestyle of something goes wrong

Once you know your risk profile, you are in a better position to choose investments which balance the risks you are prepared to take. In general, you should consider building your investment portfolio to match this risk profile, provided the expected results match your goals.

Would (temporary) falls in value affect your lifestyle?

Investments are volatile – almost all go up and down in value. In general, when assets have fallen in value in the past, this has tended to have been a temporary drop as part of a larger general rise in value.

It is important to consider whether you can ride out these short-term fluctuations. If any drop in value to your investments would have an impact on your standard of living, you should consider taking action to minimise this effect. If not, you can afford to take greater risks. Do not underestimate this issue.

Think about your own situation, and how your lifestyle would change if your investments were to (temporarily) drop by a large amount, say 40%.

Your answers to this question will guide your decisions on how to invest your money. If you need access to this money sooner rather than later, you may need to change something when investing money.

This issue goes back to the other general points already made:

- How do you fund your current lifestyle?

If you use your investments to fund your lifestyle then a fall in value could affect your income as well. What would need to change to resolve this issue? If you use other sources of income to pay for your lifestyle costs then a temporary fall in value might not be a major issue for you. - When will you need access to the invested money?

If you are investing money for the long term, then it is likely that you do not need access for many years. In this case, you can probably wait out any short-term fall in value to your invested money. If you are working towards a goal that is quite soon (fewer than 5 years), then you should consider whether that goal might be affected if the invested money was to fall in value. For example, if your investments are intended to repay your mortgage in 3 years, then a temporary fall in value could have serious consequences. This might mean you are less able to bear losses than someone who is saving for retirement in 20 years.

How much investment risk do you need to take?

Notice that we asked how much investment risk you need to take, rather than how much investment risk you are prepared to take. This is an important distinction:

- How much investment risk you are prepared to take highlights the ideal maximum risk when investing money

- How much investment risk you need to take assesses the impact of the potential returns on your overall investment goals when investing money

When investing money this can affect your investment approach in 2 ways

Risk tolerance greater than your goals

You may be prepared to take greater investment risks than your lifestyle requirements when investing money. In this case, you might want to spend more money, or take less investment risk. For example, if you describe your risk profile as moderate, but an analysis of past investment returns shows that you only need to take cautious risks to achieve your goals, then why take the extra risk? If you do not need to take risk, then why do it? You may be prepared to continue to take greater investment risks than strictly necessary when investing money. This could be because you hope to achieve your goals sooner than planned, or because you will use the potentially greater returns towards loftier ambitions with your lifestyle.

Your goals are greater than your risk tolerance

You may have more ambition for your lifestyle than your investment risks will allow. In this case, you might want to readdress your expectations, or take more investment risk. If you do not do so, you are likely to underachieve when investing money, and might not get to your overly-ambitious goals. You might have to spend less later on, or put back your goal dates. Some cautious investors should consider taking extra risks to achieve their goals.

Investments and inflation

Inflation is the rising cost of living that typically takes place.

When you consider how to invest your money you must take inflation into account, because the value of money now will feel like less in the future. The longer the period, then the greater the effect of inflation on your investments.

Inflation has generally been lower in the last few years than it has been in the past. But this does not mean that the effects will not be strong when investing money.

How does inflation affect the value of money?

The Bank of England has a helpful inflation calculator, which allows you to work out how past inflation rates have affected prices for goods, on average. This uses the Consumer Prices Index (CPI), which is the UK Government’s preferred measure of inflation.

The table shows how much money £100 in the year shown would cost today.

| Year | £100 then costs what in 2019? | Average inflation rate |

|---|---|---|

| 2009 | £135.15 | 3.1% |

| 1999 | £174.61 | 2.8% |

| 1989 | £250.67 | 3.1% |

| 1979 | £509.75 | 4.2% |

Using this data gives us a way to estimate the expected inflation rate in the future, but of course we need to keep this under review. We tend to use an expectation of inflation at 3% when preparing our financial plans as this is the average rate of inflation over the past 20 years.

When investing money for our clients, we use inflation as an effective cost on the returns of your investments. This effectively means that when you consider how to invest, you have to save more money to reach your goals, as those investment goals are likely to cost more money in the future due to the effect of inflation.

Your own inflation rate might not be the average inflation rate

The Government uses the Consumer Prices Index (CPI) for most of its measurement of inflation, but not for all areas. This uses a ‘basket of goods’, which is deemed to represent general spending in the economy. However, this measure does not include lending costs or Council Tax. It does include some curious items, which you may consider that you might not choose to buy, and these are weighted to attempt to balance their effects. As a result, CPI is useful to measure the whole economy, but might be less so for you personally. There is some evidence that lower-paid, or more elderly people pay a higher portion of their income for some services (such as heating, or food). When these costs are rising, their inflation rate could be much higher.

Your investment schemes may use alternative inflation rates

Another issue to consider is that your future income might use different inflation rates to your overall assumptions.

You might take 3% as a general assumption for the inflationary impact on your investments. However:

- The State pension uses the ‘triple lock’ – it rises by the greater of CPI, average earnings, or 2.5%

- Final salary pension schemes use different rates to revalue future pensions, depending on the period when the income rights were accumulated

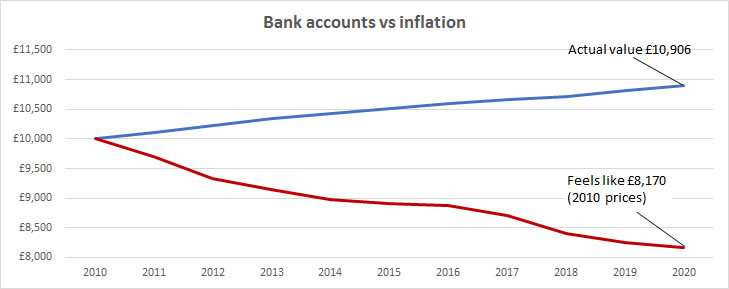

Too much cash – inflation eats investment growth

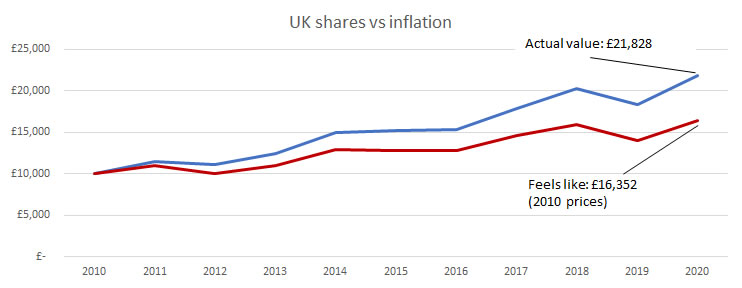

As explained above, inflation is another type of risk and has an underestimated impact on returns over time, especially when investing money. Often people focus on the actual rates of return without reflecting on the impact of the increase in the cost of living. This is particularly true with low-returning bank accounts.  The above chart shows how bank accounts can be eroded by inflation. It shows a sample £10,000 saving into a bank account, made at the start of 2010.

The above chart shows how bank accounts can be eroded by inflation. It shows a sample £10,000 saving into a bank account, made at the start of 2010.

- The blue line shows the actual growth of the sample bank account – you would have made a measly £906 after 10 years

- The red line shows what that account would have felt like after 10 years – your bank account would feel like it lost you £1,830

While inflation is currently lower than historical averages, cash savings are currently losing money in real terms. If you hold too much cash you are simply exchanging volatility risk for inflation risk. The longer you put off taking risk with your investments, the greater the risk that inflation will eat into your savings.

Shares preserve purchasing power

Shares have a greater chance of beating the risk of inflation over time, but come with increased volatility as part of their nature.

As a result, if we manage your investments, we will give your investment portfolios as much shares as we think is suitable to achieve your financial planning goals, within the limits of risk that you are prepared to take.

Generally, the more shares you hold, the better your chance of long-term growth. When investing money in shares you have to factor in an expectation of occasional sharp, but temporary falls in value.

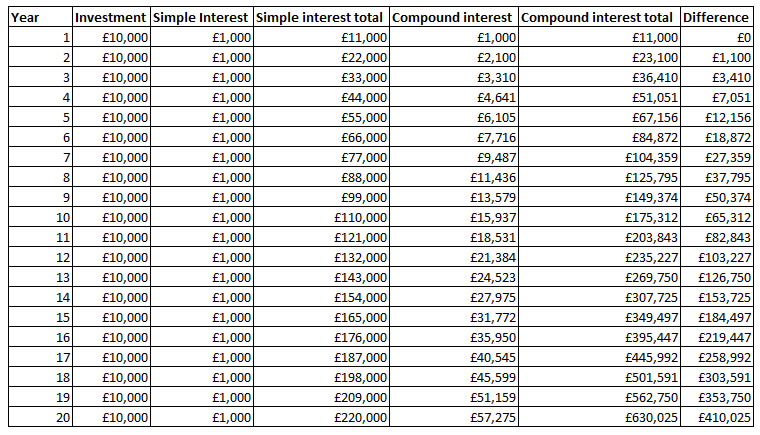

The above chart shows how an investment of £10,000 made in 2010 into UK shares has outperformed inflation. It shows the return of the UK stock market, after allowing for the cost of living (in 2010 prices). After adjusting for the cost of living, shares have tended to grow in real terms.

- The blue line shows the actual return over 10 years – £11,828

- The red line shows how this growth would have felt after the effects of inflation. It would still have been impressive at £6,352, and certainly better than a bank account.

The price of this growth is short-term (temporary) fluctuations in the value of your holdings

Compound interest

Compound interest is the effect of producing interest on already accumulated returns, not just the original investment (in effect, interest on accumulated interest).

This effect is important when considering how to invest. Compound interest will help you to grow your assets faster, the longer they grow. With compound interest, generally the largest growth will come in the final years of your investments.

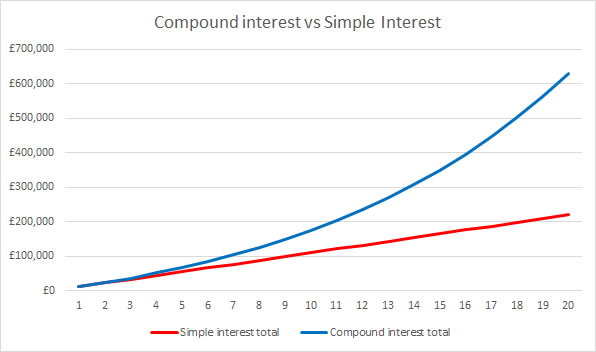

The data below compares simple interest to compound interest, assuming £10,000 is invested each year, with a growth rate of 10% per year. Bear in mind that these growth rates are just used to illustrate the effect of compound interest when investing money, and may not be actually achievable over 20 years!

You can see from this table that after 20 years, using simple interest you would gain £20,000. Using compound interest the total interest would be £430,025.

Here is the same data in a chart:

You can clearly see that the compound interest produces the most gains the longer you invest your money. When considering how to invest, this concept of time becomes very important.

Reinvesting income boosts returns when investing money

Most invested assets generate some income (such as dividends or interest).

If you do not tell them otherwise, your investment provider will pay the income on a regular basis into your bank account. If you spend this income you are not using compound interest to the fullest. If you instead reinvest this income, to buy more of the same asset, your returns can be boosted dramatically.

This applies to investment portfolios built for capital growth; income portfolios should therefore expect lower capital growth over time as the income is spent and the money cannot be used to boost the overall capital growth of your investments.

How reinvesting income can boost your investments

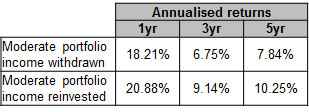

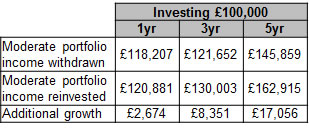

This table shows the average returns for our moderate income model portfolio for the 5 years to the end of 2019. With income reinvested, the returns were boosted by 2.41% per year over 5 years.

This table shows the additional growth produced by the same portfolio, assuming an investment of £100,000. After 5 years, the reinvestment of income produced £17,056 in additional growth.

Time in the markets reduces the chance of capital losses

The length of time invested is an important factor in your portfolio.

Essentially, the longer the investments are held, the more likely you are to grow your money. There are natural cycles of investment growth when investing money, although it is almost impossible to predict these in advance. Therefore, the general principle should be that you should not invest money unless you are prepared to commit your funds for a considerable period (say 5 years).

Time in the market – UK stock market data

Take a look at this data on the UK stock market over 20+ years. The data on the UK stock market over 20+ years shows that the longer you are prepared to invest, the less likely you are to experience loss of your original capital, although there of course have been periods when this happened.

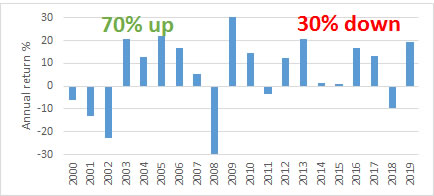

UK stock market – 1 year returns for 2000 to 1999

Measuring individual years, between 2000 and 2019 the UK stock market rose 70% of those years, and fell 30% of those years. This is why the general trend tends to be upward over time for the UK stock market. If the stock market rises 7 years out of 10, and falls 3 years out of 10, then the overall trend should be towards growth.

Measuring individual years, between 2000 and 2019 the UK stock market rose 70% of those years, and fell 30% of those years. This is why the general trend tends to be upward over time for the UK stock market. If the stock market rises 7 years out of 10, and falls 3 years out of 10, then the overall trend should be towards growth.

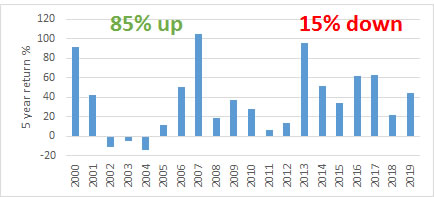

UK stock market – 5 year rolling periods ending 2000 to 2019

The same data as above has now been expanded to show 5 years of investment into the UK stock market, finishing at the end of the years shown on the chart. This shows that over this period, investing for 5 years would have generated a positive return in 85% of the periods, and a loss in 15% of the periods. The general message is that a 5-year investment period has proved to reduce the chance of loss to capital when investing money – for investments into the UK stock market only.

The same data as above has now been expanded to show 5 years of investment into the UK stock market, finishing at the end of the years shown on the chart. This shows that over this period, investing for 5 years would have generated a positive return in 85% of the periods, and a loss in 15% of the periods. The general message is that a 5-year investment period has proved to reduce the chance of loss to capital when investing money – for investments into the UK stock market only.

UK stock market – 10 year rolling periods ending 2000 to 2019

The same data has now been expanded to show 10 years of investment into the UK stock market, finishing at the end of the years shown on the chart. This shows that over this period, investing for 10 years would have generated a positive return in 100% of the periods, and a loss in 0% of the periods. This appears to show that a longer investment period reduces the chance of losses to capital for investments in the UK stock market. Of course, none of this is guaranteed to be repeated when investing money.

The same data has now been expanded to show 10 years of investment into the UK stock market, finishing at the end of the years shown on the chart. This shows that over this period, investing for 10 years would have generated a positive return in 100% of the periods, and a loss in 0% of the periods. This appears to show that a longer investment period reduces the chance of losses to capital for investments in the UK stock market. Of course, none of this is guaranteed to be repeated when investing money.

Time in the market – different risk-rated investment portfolios

The same general conclusions can be expanded to other investment strategies when investing money.

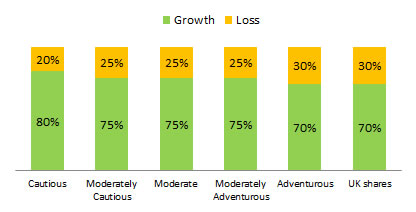

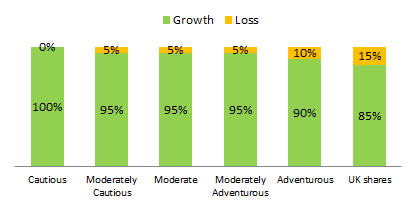

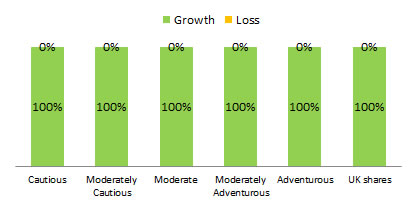

After all, few people would consider investing money wholly in the stock market alone. The data below examines how managing risk with our investment portfolios changes the data on gains versus losses over time. This data shows the annual rolling periods over the last 20 periods to the end of 2019, using the average returns for the investment sectors we recommend, and adjusted for the percentage mix of the investment sectors used in our Model investment portfolios. If you click on the link, you can see the latest published returns on these investment portfolios. Bear in mind that this is not guaranteed to be repeated, but this data bears out the general point that the longer you are able to invest, the less likely you are to lose some of your original capital

Our model portfolios – 1 year returns for 2000 to 2019

This data shows that by taking a risk-rated approach to our professionally-managed portfolios, our asset allocation seems to reduce the periods of loss and increased the periods of growth when compared to the UK stock market. This demonstrates that proper asset allocation, and diversification in your investments is important to manage the risks of loss.

This data shows that by taking a risk-rated approach to our professionally-managed portfolios, our asset allocation seems to reduce the periods of loss and increased the periods of growth when compared to the UK stock market. This demonstrates that proper asset allocation, and diversification in your investments is important to manage the risks of loss.

Our model portfolios – 5 year rolling returns for periods ending 2000 to 2019

This data shows that our asset allocation further reduces the risk of loss (based on past data), for lower risk investments when compares to the UK stock market.

This data shows that our asset allocation further reduces the risk of loss (based on past data), for lower risk investments when compares to the UK stock market.

Our model portfolios – 10 year rolling returns for periods ending 2000 to 2019

This data again backs up that the risk of loss has tended to be minimised the longer the investment period.

This data again backs up that the risk of loss has tended to be minimised the longer the investment period.

Investment diversification

One of the best ways to manage risks is to diversify your portfolio.

Investment diversification is important because before you buy an investment you cannot be sure how each asset will perform. The aim of investment diversification is to limit the downside for cautious investors, while accepting that the upside will not be as great.

More adventurous investors will be prepared to accept greater short-term losses in their investments, in the expectation that greater returns can be achieved over time. In our experience lack of investment diversification is one of the most common mistakes that amateur investors make.

Advantages of investment diversification

- Limit downsides

The main benefit of investment diversification is that you hope that your assets will react differently to various events – by spreading your investments around different asset types you hope to limit the downside in negative periods. Research has shown that investment diversification limits the downside of your portfolio without too much impact on the upside. - Reduced volatility

Most diversification tries to limit volatility in the portfolio by controlling how much assets rise and fall. Diversification is unlikely to mean that you can avoid falls in the value of your investments. However, the aim is to slow falls when markets shift dramatically. - Longer-term results

Some studies indicate that a properly diversified investment portfolio can add to longer-term results.

Disadvantages of investment diversification

- Short-term gains can be limited

Investment diversification can mean that you lose out on short-term gains of more volatile investments. - Time and administration

Investment diversification adds to the complexity of a portfolio, meaning greater administration, and time spent managing the strategy. This is one reason why many amateur investors do not diversify their investments; it takes time and effort. - Higher costs

Inevitably, if you diversify investments you are more likely to hold a wider range of assets. This can mean greater costs as some assets are just more expensive. Wider trading can also increase transaction costs.

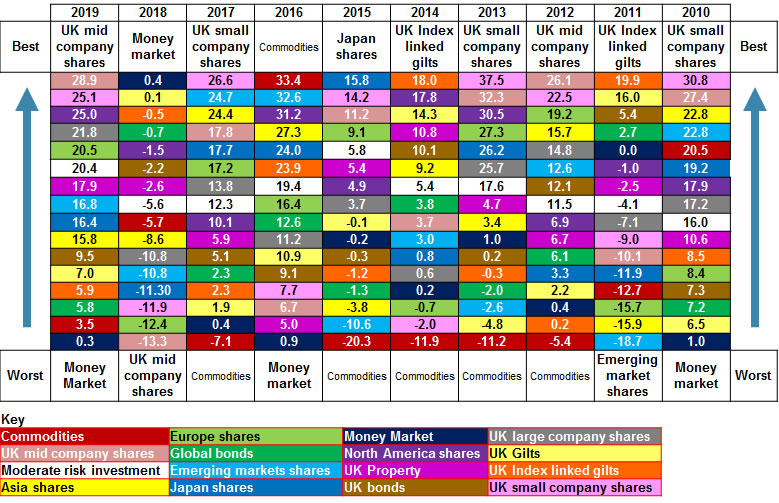

Why diversify? Predicting investment winners

Take a look at the data below. This shows the returns of the various investment sectors that we use in our model portfolios. This has been presented to show the percentage return before charges from top to the bottom for the last 10 years. It is very difficult to predict a winner from this data, which is why instead we spread your money between these assets.

This data shows exactly why investment diversification is so important when investing money. It is almost impossible to predict how assets will perform ahead of time, so we do not try to do this. Predictions are nearly always wrong. If you look at the data presented, you will see in white the results of our model moderate risk investment portfolio over those years. Clearly, this investment portfolio was never the top performer, but you can see the effect of diversification in action. The moderate risk portfolio was generally in the mid-range of returns, with much of the upside, but less of the worst-case scenarios.

Types of investment diversification

This section explains more about the complex arrangements to allow you to invest money in a properly diversified portfolio.

Type of investment

There are a wide variety of ways to hold a diversified investment, even within a tax wrapper like an ISA.

- Holding direct investments

You can buy your investments directly, which is typically how a stock broker would arrange investments for you. They might diversify when investing money by buying a portfolio of individual shares. You could hold dozens of companies, and that would spread your risk (see Number of Holdings, below). - Collective investments

We recommend collective investment funds, also known as pooled investments when investing money on behalf of clients. These come in a variety of forms, such as unit trusts, OEICs, ETFs, or investment trusts. Taking aside the technical differences, the main feature that unites these investments is that they pool your money with other investors, and effectively hold a basket of direct investments according to the goals of the fund. For example, if you buy a large UK companies investment fund, this will hold a wide variety of UK large company shares in various proportions according to the judgement of the fund manager. This means that you can outsource the direct investment decisions to experts in that investment area. We might further diversify when investing money to hold a variety of collective investments.

Number of holdings

You can diversify your investment and spread your risk by increasing the number of holdings.

For example, if you hold a single company’s shares there is no diversification of your investments. If this company stops trading, then you lose your entire investment. If instead you hold 100 companies equally, and a single company fails, you only lose 1% of your overall investment. A professionally managed investment portfolio is likely to use collective investments, which hold a variety of underlying investments. You might buy a single fund that could hold 50-200 actual investments.

Types of asset

You can increase investment diversification by using a variety of types of asset.

Our model portfolios use the asset types in different proportions according to the risk profile, and the outlook of the investment approach:

- Cash or Money Market

This might be actual cash held within your investment portfolio; alternatively you could use investments that work like cash, such as Money Market funds, which use a combination of cash, and other complex instruments. Cash does not return a capital growth, but does pay interest, typically at a relatively low rate of return. This asset tends to be the lowest volatility of the investment types we use, but also has the lowest returns. We use these investments to dampen down volatility when investing money. - Fixed interest

Fixed interest means corporate debt or Government debt, either in the UK (known as gilts) or overseas. These investments can fluctuate according to demand, and pay a fixed interest for the length of the investment, which is often determined at outset. Fixed interest tends to be lower volatility than other investment types (not always). We use fixed interest broadly to provide lower volatility to a portfolio, but also to hedge against inflation over time. What tends to happen is that much of your fixed interest investments return capital growth equivalent to the cost of living over a longer period. Of course, this is not always true, and there can be periods of higher volatility even with typically “safer” investments. Fixed interest can be sub-divided into further categories. For our model portfolios we use UK gilts, and index-linked gilts, plus corporate bonds (split into investment grade, high yield, and overseas corporate bonds). - Property

Most investment funds buy into commercial property rather than residential property. These investments tend to provide capital growth over time, but also pay an income from rent. You can buy funds that own property directly (i.e. they own the actual buildings and then lease them to a company). Many household names you might know do not own the company premises, or retail units. Instead, they lease these buildings from a property investment fund. These property funds benefit from a stable income source, and capital growth over time. However, at times of economic stress the funds may not be as liquid to sell as investments that trade on a recognised exchange. These investments can temporarily close to new investors, or halt sales, while the fund is allowed to sell property to generate the cash demanded by investors. The alternative is to buy property investments that trade in shares of companies that hold property. These tend to be more volatile, but can be traded at any time. Of course, there are many other ways to hold property in an investment, including direct purchase of a property. - Shares or Equities

Shares are where you are investing money directly into a company. Effectively, you own a proportion of the company according to the number of shares held, out of the total issued shares. Shares tend to provide long-term capital growth (provided the company performs well). The equities also provide an income as a dividend. Shares are the highest volatility investment that we recommend, but tend to provide the greatest growth over time. We include shares when investing money to give you growth or income above inflation over time. You can sub-divide shares into a wide range of asset types, including within the UK, larger or smaller companies, as well as other locations worldwide.

If you use different types of asset you can spread your investment risk because they each perform well at different part of the economic cycle. Ideally, your investments should have an element of negative correlation as this means that when one asset type does poorly, another might be doing well. This can be difficult to achieve as many asset types have inter-linked fortunes when markets fall. For example, if the economy performs poorly you might expect shares to fall in value; if this happens, property prices might also be affected – there might be a correlation between these types of assets. In general, we use the same types of asset in all of our model portfolios, but we use greater proportions of more volatile assets (like shares) in the more adventurous portfolios, and less of these asset types in more cautious investments. The reverse also applies: we use greater amounts of less volatile investments (like fixed interest or cash) in cautious portfolios, and lower amounts in adventurous investments. Our typical investment portfolio holds 15 investment funds, each in a different sector. Each fund has between 50-200 holdings. This means your investment might average 1,875 individual holdings.

Geographical locations

You can improve investment diversification by holding assets in multiple jurisdictions.

Many investment portfolios naturally focus on the home country, but you can spread risk by investing money outside of your own country. We tend to use a variety of methods to diversify your portfolio into overseas assets. We buy shares in North America, Europe, Asia, Japan, and other Emerging Markets. We also spread your fixed interest investments into UK fixed interest, and global fixed interest.

Currency

If you diversify investments you are likely to spread your holdings into a variety of geographical regions.

This can increase the risk of currency fluctuations. Spreading your investments across different currencies can have a diversifying effect, but it can also amplify the risks when your home currency changes dramatically. As an example, imagine that you live in the UK, but hold an investment held in US Dollars. If the US investment rises, you will see the benefits in the return; if UK Sterling also falls a the same time then your US holdings will rise at a faster rate. This effect can work in reverse as well: if your US holdings fall in value while UK Sterling rises, then your losses will be greater.

One way to manage this can be to hedge your investments against currency fluctuations, and some investments offer this as an option (probably for additional cost). The investments use complex financial instruments to attempt to head off wide fluctuations in currencies.

Non-correlated assets

One problem with investment diversification is that we live in a connected world. It can be difficult to find asset types that always perform in opposite ways. In an ideal world your diversified portfolio would have some investments that increase, while others decrease. Unfortunately, many typical investments show positive correlation – they tend to rise or fall in value at similar times. Different investment types can temper this, but you may benefit from holding assets that perform quite differently. Our model investment portfolio typically holds commodities for this purpose. Commodities is a wide term that tends to include items such as precious metals or agricultural products. These investments often have a different investment cycle to shares or fixed interest. However, commodities tend to be highly volatile.

Diversification of non-invested assets

When investing money do not forget that other assets should be taken into account for your diversification. For example, your main home is property and your bank savings is cash. Having too much of one asset type can skew your investment diversification; you may need to reduce your invested holdings in these areas to compensate.

Simple diversification options

Some investments are designed to make the process of investment diversification easier for you. For example, you can buy widely diversified investment funds such as a managed fund, which aim to provide a broad range of asset types within one investment. This can be a good approach for a limited goal, but many not be appropriate for longer-term specific goals where tailoring and timing are important.

Rebalancing your investment portfolio

Naturally, each of the assets in your portfolio will perform in a different manner at various stages of the economic cycle.

Typically, over time, riskier assets will tend to grow faster to form a larger proportion of your portfolio. This in turn alters the risk of your portfolio. If you leave your assets with the original investments and make no changes, in general you will gradually see the riskier assets out-performing the safer assets. If you make no changes, your investment portfolio is likely to take more risk after longer periods.

To minimise the risks of this happening, when investing money we will recommend that you switch holdings back towards the ideal asset allocation. We would typically arrange this annually, but some advisers rebalance portfolios more often. The downside of rebalancing investments is that this generates additional costs and complexity. The positive side keeps your investments on track in terms of risk.

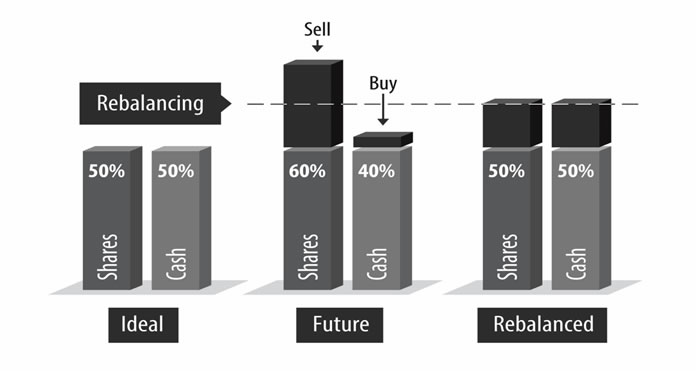

How does investment rebalancing work?

Imagine that you are investing money with a portfolio split half with cash, and half with shares (the “Ideal” stage). This is not an optimised diversification strategy, but is useful for our example!

If that was you ideal asset split for your chosen risk level, then you should aim to retain this balance of assets over time. Imagine that some time has passed and you move to the “Future” stage. In our example, the shares have grown in value (the reverse could be true), and the cash has also grown, but by a lesser amount. In this example, the shares are now worth 60% of the total, and the cash 40% of the total. In this case, the faster growth of the shares means that the future investment portfolio takes greater risks than the ideal portfolio. The solution is to move to the “Rebalanced” stage. You should sell some of the higher growth items and but some of the lower growth items. This will reset your investment risks.

Academic research has estimated that rebalancing investments can add up to 0.5% to annual returns over the longer term.

How do we rebalance investment portfolios?

Of course, our professionally managed model investment portfolios use more than 2 asset types, so the rebalancing we perform is more complex than shown in this example.

However, the principle is the same – to bring your investments back in to line with the ideal risks you are prepared to take, and need to take. If you use an adviser like us, then portfolio rebalancing should be part of the service.

Market volatility

When considering how to invest bear in mind that all investments rise and fall in value.

This is true of property and shares in particular. It could be said that investment volatility is the price that investors pay for above-inflation investment growth over time. In turbulent stock market periods it can be tempting to reduce the risk of your portfolio by biasing the portfolio more towards safer assets.

If you are investing money try to avoid the news – it only focusses on short-term negativity, rather than longer-term positive trends. The truth is that investment markets are not always rational, and there are always apparent risks on the horizon. Part of our role is to help you to stay invested when markets change. Selling holdings when markets change can hamper future performance in the longer term, or even to lock in losses.

It is best to trust in the process of the portfolio and markets, so that you can benefit from any recovery in the market. A big stock market fall in one period is often followed by a big gain swiftly afterwards. These periods of turbulence become less important over time.

Market timing

It can be tempting to try and make short term gains on portfolios by moving in and out of the different markets. This is how many amateur investors see how to invest.

This behaviour almost always leads to losses, or at least lower returns over time. Even with very strong market and economic data, this approach is almost impossible to get right every time. For this reason, when investing money portfolios should be put together to deliver longer-term performance rather than taking active short term bets. We try not to guess the market because we know we will never get the timing right. Instead, we focus on delivering stable returns over the medium to long-term. In general, this means buying investments, and holding them for the long term, even when markets rise and fall. The aim is to get rich slowly, over time.

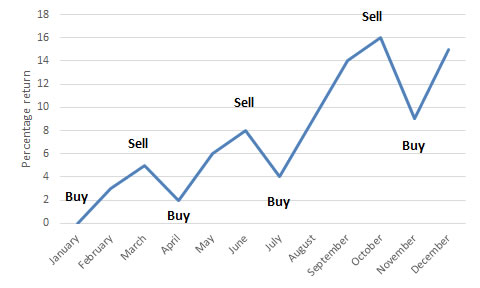

An impossible view of market timing

Many amateur investors think investing money is about buying when the market is low, and selling when the market is high (demonstrated by the example chart above). Of course, if you do get this right you will make spectacular gains (if only it were this easy!). The reality is that it is usually impossible to know where you are in the cycle, so you may delay decisions until the market has peaked, or possibly when it has started to rise. Changes tend to be swift, and bigger when the market shifts direction. You are better off holding your nerve and letting the market produce for you over time.

Market timing in practice

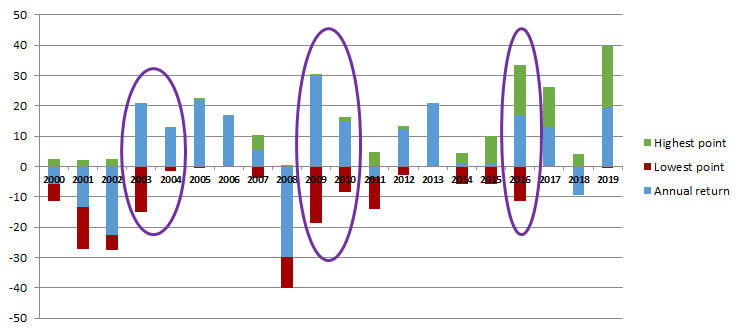

This chart shows the returns for the UK stock market for the past 20 years. The blue bars represent the percentage return for the stock market in the UK for each of the last 20 calendar years. The green shows the highest position during that year, and the red, the lowest position. Looking at this, in 2016, at various points during the year the UK stock market had

This chart shows the returns for the UK stock market for the past 20 years. The blue bars represent the percentage return for the stock market in the UK for each of the last 20 calendar years. The green shows the highest position during that year, and the red, the lowest position. Looking at this, in 2016, at various points during the year the UK stock market had

- Fallen by over 10% (red)

- Risen by over 30% (green)

- Ended up returning over 15% for the year (blue)

The purple ovals highlight that during many years the stock market shows a loss part-way through the year, which eventually converts into a gain by the end. You should not aim to time your entry or exit from the market as you run the risk of getting this dramatically wrong. Imagine if you sold out at the worst position in 2009 (-18%), only to then see the stock market recover to +30% by the end of the year. We see this in action regularly with people who do not consider how to invest properly. They either wait too long to invest (out of fear of losses), or chase gains at a time when the market has already peaked. Data shows that more people sell shares when the market falls, and more people buy shares when the market rises. Neither is logical, and neither will generate ideal returns over time.

Holding enough cash

One way to balance investment volatility is by holding an appropriate amount of cash.

We have already highlighted above how cash tends to lose value compared to inflation over time, so it is important to get this balance right depending on your situation. It can be tempting to hold too much money in your investments, which may not be easily accessible, or could fall in value at the wrong time. We believe you should balance your long-term investments against your short-term need to access capital for emergencies, projects, or income.

You should hold enough cash to pay fees within your portfolio. Otherwise, your investments may need to be sold to pay these fees.

Holding a cash buffer for income

If you take an income from your investments, this could be affected in the event that your investments temporarily fall in value. Investment downturns are inevitable, and unavoidable, so it makes sense to prepare when investing money. If you invest into a long-term portfolio, but take a fixed income this may eat into your capital faster when your investments fall in value.

In extreme situations, you might run out of money much sooner if the timing goes against you (especially if the fall in value happens at the start of the fixed withdrawal period). One solution is to reduce your income when the capital value falls.

An alternative is set out below:

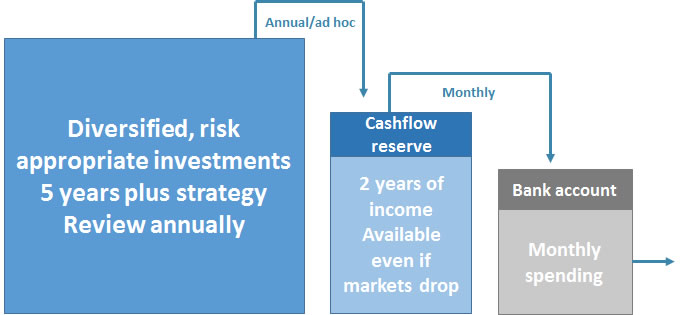

This diagram shows how an income cashflow reserve can work in practice. The idea is to hold around 2 years variable income in a cash account. This is a compromise between having your money invested for longer-term growth, and having enough cash available to continue with your planned lifestyle costs in the event of a short-term market fall.

If your investment happen to fall in value, you can use your cash buffer to wait out the downturn, and only go back to taking withdrawals once markets have recovered. Of course, even this approach is not guaranteed, but it does mean that you can pay less attention to the stock markets when they are falling. You should let your long-term investments to grow over time, but keep a sensible cash reserve to cope with short-term investment fluctuations.

Investment costs and tax

It is important to understand the charges of your product, the investments funds, and any transaction costs.

While necessary, the investment charges are a drag on the performance of your investment. Low cost is good, but not always the best. If you can buy the same investment at a cheaper cost, you will get a larger net return. However, a wider investment choice can lead to larger returns, even if the costs are greater.

Types of investment charges

Why are investment charges important?

Investment charges are important because they act as a drag on your investment returns.

Suppose your investment returns 8% in one year, but you are charged 2%, the net return will be something like 6%; if the same investment only charged you 1%, the net return might be 7%. This means that you should pay close attention to the charges of your investment since they can seriously reduce your investment growth over time.

Of course, having a lower-cost investment does not necessarily mean you will achieve higher net returns. If the higher-cost investment achieved 10% return before charges, but charged you 2%, you would end up with 8% net return.

If the lower-cost investment achieved 8% return before charges, but charged you 1%, you would end up with a net return of 7%. As you can see it is not a straightforward issue but is one to which you should pay close attention.

Types of investment charges

Typically, if you invest money, you could be subject to any of the following types of investment charges:

- Investment management charges

These charges cover the cost of research and managing investments on your behalf. Investment management charges are typically deducted from the investments you buy. - Product fees

These charges cover the cost of managing your investments within a given tax wrapper, possibly on a single investment platform. Investment product fees are typically deducted from the investments you buy. - Adviser fees

These charges cover the cost of providing financial and tax advice on the suitability of your investments. You can pay these fees via deduction from the investments you hold, or separately. - Tax

Your investments may also incur tax on purchases, capital gains, or income. We consider investment tax in a separate section below.

How do investment charges work?

This section gives you an idea of the type of charges you would pay for buying retail investments such as OEICs and unit trusts. The charges set out below assume you buy your investment directly with the investment provider. We have compared this retail approach to one assuming you use a financial adviser in the next section.

Initial charges

Many retail investment funds charge up to 5% of the initial capital. These charges vary and are gradually reducing due to competition. Many investment funds have no initial charges.

To put this into context, if you invested £100,000 the initial charge could be as high as £5,000. in this scenario, £95,000 would be invested. The initial charge could also apply to regular savings. For every £100 you save, £5 could go in charges, leaving £95 to be invested. This initial fee is calculated differently for unit trusts, but it effectively works out as a charge of up to 5% of your initial investment.

Annual charges

- Annual Management charge (AMC)

Investment funds typically charge an Annual Management Charge (AMC). This pays for the management of your investments as well as other annual costs. For a share-based investment fund the typical retail Annual Management Charge is 1.5% of the total investments per year. Some types of investment funds, such as corporate bonds, have typically lower Annual Management Charges. Some, more complex investments have even greater Annual Management Charges. - Transactional charges

Unfortunately, the Annual Management Charge is not the end of the story for annual investment charges. You also need to look out for additional charges. These can include transactional charges such as dealing costs, trustee fees and taxes paid by the investment managers. These tend to be quoted separately to the Annual Management Charge of the fund and might add an additional 0.25% per year (sometime much greater) to the Annual Management Charge. In general, the more the fund manager buys and sells investments, the greater these transaction costs can be. A study by the financial regulator estimated that trades made by fund managers account for additional fees which are very difficult to track. - Performance fees

Some investments have an additional performance fee which is payable if the investment beats a certain level of returns, perhaps beating an index. These can be as high as 20% of the excess returns above a certain level. The argument is that the fund manager has done so well in that year that they can justify this additional charge. - Ongoing charges figure (OCF)

Most investment funds display the ongoing charges figure on factsheets, and the Key Investor Information. The OCF takes into account ongoing charges, and includes the Annual Management Charge (AMC), as well as dealing costs, but not necessarily all transactional charges. The Ongoing Charges Figure does not include performance fees (where appropriate). - Total Expense Ratio (TER)

Some investment funds are still permitted to display the Total Expense Ratio (TEF). This is like the Ongoing Charges Figure (OCF), but also includes performance fees (where appropriate).

As you can see, it is not always easy to compare the charges of investment funds on a like-for-like basis. You should compare investment charges carefully.

Exit charges

Some investments have a charge for exiting the fund, perhaps before a certain date.

These are typically applied to older investments and are rare with most collective investments such as OEICs and unit trusts. Just be careful to check these do not apply to you before you sell an investment.

How do investment product fees work?

Investment product fees can vary widely between products, depending on whether they are marketed directly to investors (usually more expensive), or via investment advisers or brokers (usually cheaper due to economies of scale).

Investment wrapper

As financial advisers we typically recommend that clients invest via an investment wrapper. These are administration platforms which allow us to buy and sell investments for you, and to make trades easily. They have a number of benefits:

- Simpler administration

The idea of these platforms is that they allow you to keep all of your investments in one place, thus making your administration burden much lower. This convenience helps you to keep track of your investments much more easily. - Transparent charges

Most investment wrappers allow you to clearly see the charges that you pay. This transparency is generally having a downward pressure on costs as platforms complete to win and retain business. - Access to a vast array of investments

Investment platforms allow you to buy from a massive array of investments. Instead of choosing from 50 funds offered by one investment provider, you can instead choose from thousands. in some cases, the range of investments is unlimited. You can also access institutional investments, not typically open to retail investments. These can have lower charges and better fund performance. - Access to different tax wrappers under one platform

You can bring together different types of tax wrappers such as investment accounts, ISAs and pensions. This means you can move money between your wrappers when it makes sense to do this. You can also follow a similar investment strategy across all of your investment wrappers. - Buying power

These investment platforms have billions invested on them, which allows the platforms to reach deals with the investment companies to offer their investment funds at a discount. This can greatly reduce your costs. The buying power of the investment platforms typically reduces the Annual Management Charge cost of an investment by half – from 1.5% to 0.75% per year.

Investment wrapper charges

- Platform charge

Think of the investment wrapper as an administration platform. Charges vary but would typically range between 0.25% and 0.5% of the investments held per year. - Tax wrapper charges

Some investment wrappers have level annual costs for holding certain tax wrappers. These vary but might be £20 to £100 per year depending on the company and wrapper used. - Dealing costs

Some platforms charge dealing costs, ranging from a flat fee of say £5 per trade, to a small percentage of the value traded, say 0.2%.

Initial charges

It is rare for investments to have an initial charge when you buy them through an investment wrapper. This immediately saves you the 5% charge you might pay for buying the same investment directly with the provider.

Annual fund charges

The buying power of investment platforms means they can do deals with the investment fund managers for selling greater amounts of investments through their distribution channels. This typically reduces the Annual Management Charge by half, so from 1.5% per year to 0.75%. If you work this out, the total charge might look like this:

| Charge | Retail | Wrapper | Saving using a wrapper |

|---|---|---|---|

| Initial charge | 5% | 0% | -5% |

| Annual wrapper charge | 0% | 0.35% | +0.35% |

| Annual fund charges | 1.5% | 0.75% | -0.75% |

| Other annual charges | 0.25% | 0.25% | 0% |

In the example above, you would save the 5% initial charge, plus 0.4% per year in Annual Management costs. Let’s put this into monetary terms, assuming an investment of £100,000:

| Charge | Retail | Wrapper | Saving using a wrapper |

|---|---|---|---|

| Initial charge | £5,000 | £0 | -£5,000 |

| Annual wrapper charge | £0 | £350 | +£350 |

| Annual fund charges | £1,500 | £750 | -£750 |

| Other annual charges | £250 | £250 | £0 |

In this example, which is only a guide, we can see that by using a financial adviser you would have saved £5,000 in year one, plus £400 per year for every year you hold the investment. This is money which goes directly to greater growth in your investments.

How do investment adviser charges work?

Investment advice fees also reduce the growth of your investments. Of course, you should get a payoff in return for this fee:

- Comprehensive research Your financial adviser should be able to help you to choose from among the best investments available using a variety of research tools to analyse the market.

- Experience and expertise Your financial adviser should use a combination of experience and expertise to help you to avoid costly investment mistakes.

- Process Investing money is all about following a certain process to ensure that you do not miss obvious areas. Your financial adviser should help you to ensure that you have all the areas covered that you might not think of.

- Risk management A vital area in investing money is managing the risks you take. Your financial adviser should be able to help you to diversify assets, and to ensure that you take the levels of risk appropriate for your needs. They will also ensure that your investments are regularly brought back into line over time to avoid you taking a different level of risk to the one you signed up for.

- Ongoing service Your financial adviser will be on call to regularly review your portfolio, and to answer questions you may have. This is probably the most important area.

Ways to reduce investment charges